W-2 Information

Statement regarding Overtime

Statement regarding Overtime![]()

Statement regarding Overtime

On July 4, 2025, the One Big Beautiful Bill Act was signed into law, introducing a new federal tax benefit for employees who earn overtime pay. This provision allows eligible employees to claim a federal income tax deduction for a portion of their overtime earnings. To qualify, employees must work more than forty hours per week, receive overtime pay at time-and-a-half, possess a valid Social Security number, and not use the Married Filing Separately tax status. This tax deduction is for federal taxes only. Overtime pay is still subject to Social Security, Medicare, and California State taxes.

All taxes, including federal taxes, will continue to be withheld from your paycheck. The tax deduction will be applied when you file your taxes for the applicable calendar year.

Although this Bill was signed on July 4, 2025, it is effective January 1, 2025. For the 2025 transition year, you will either see the qualified deduction amount in Box 14 of your 2025 W-2 or you will receive a supplemental statement. We expect to receive the supplemental statements from LACOE in 3 weeks. It is likely that most employees will receive a supplemental statement versus it appearing on your 2025 W-2. Once received, we will communicate the method by which these will be provided to you. Starting in 2026, qualified overtime will be reported in Box 12 of the W-2, using code "TT".

IT IS IMPORTANT TO NOTE THAT THE PAYROLL DEPARTMENT IS NOT RESPONSIBLE FOR CALCULATING WHAT QUALIFIES FOR THE FEDERAL TAX DEDUCTION. THIS IS SOLELY THE RESPONSIBILITY OF THE LOS ANGELES COUNTY OFFICE OF EDUCATION (LACOE).

Single filers are able to claim up to $12,500 per year and married couples filing jointly are eligible for up to $25,000 annually. Importantly, only the extra half of overtime pay - the amount paid above the regular hourly rate - can be deducted. For example, if an employee's regular rate is $20 per hour and their overtime rate is $30 per hour, only the $10 difference qualifies for the deduction. However, this benefit phases out for higher earners, beginning at a modified adjusted gross income (MAGI) of $150,000 for single filers and $300,000 for joint filers, with the deduction reduced by $100 for every $1000 above these thresholds.

Employees are encouraged to consult a qualified tax professional when filing their return to maximize their benefit and for specific questions.

The overtime provision of this bill is temporary and is set to expire on December 31, 2028, unless extended by Congress.

Physical W-2's for 2025

Physical W-2's for 2025 ![]()

Physical W-2's for 2025

If you did not opt in for Electronic W-2 then physical W-2 forms will be mailed no later than January 31st. W-2s are issued and sent by LACOE, not by the Payroll Department.

If you do not receive your W-2 by February 1st, you may contact the Payroll Department during the first week of February for assistance.

Electronic W-2's for 2025

Electronic W-2's for 2025 ![]()

Electronic W-2's for 2025

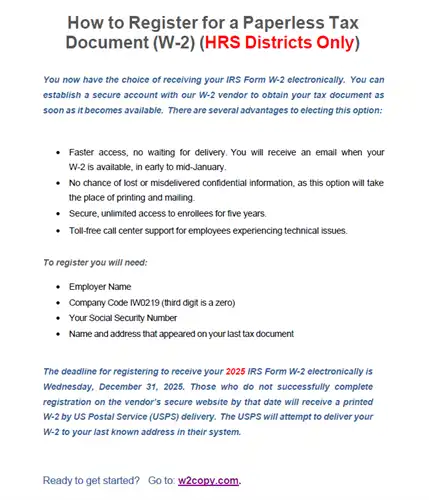

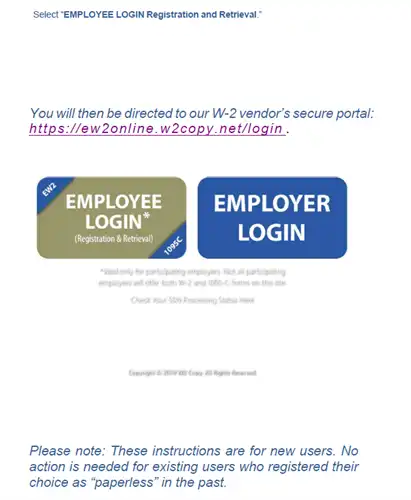

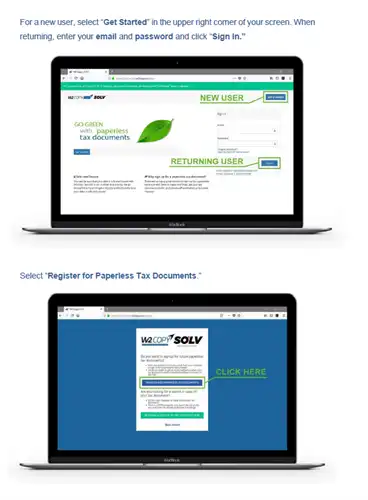

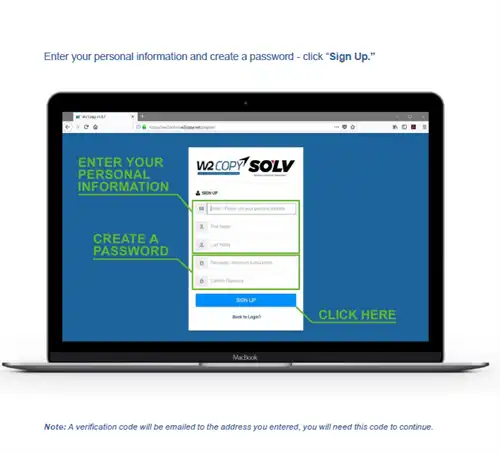

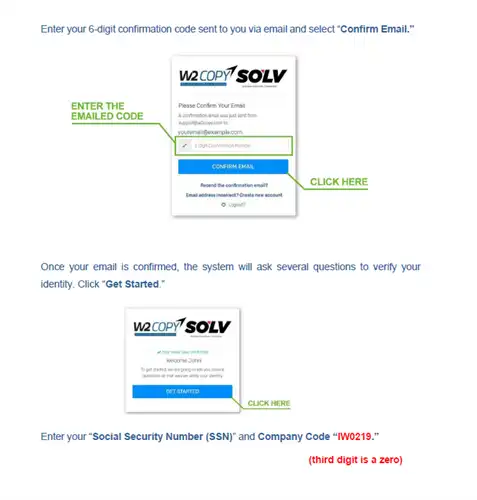

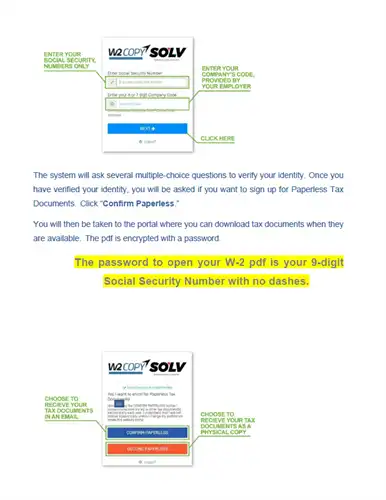

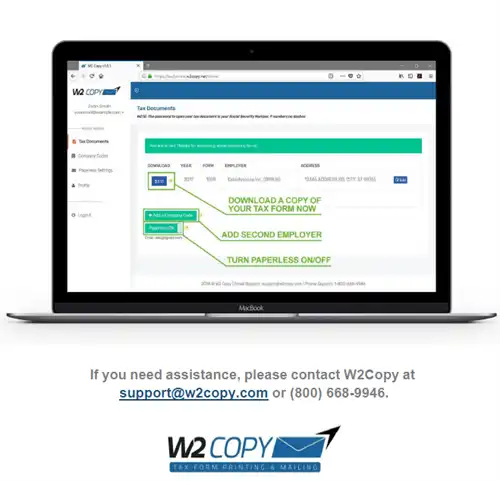

If you are currently registered to receive your W-2 electronically, you do not need to re-register. If you are setting this option up for the first time, below are the instructions from LACOE.

The deadline to enroll in this service is Wednesday DECEMBER 31, 2025.

Please contact W2Copy for assistance. The district does not have access to these files.

support@w2copy.com or (800) 669-9946